How to Calculate Cagr Excel?

Are you looking for an easy way to calculate CAGR (Compound Annual Growth Rate) in Excel? If you are, then you have come to the right place! In this article, we are going to provide a step-by-step guide on how to quickly and accurately calculate CAGR in Excel and provide helpful tips and tricks to make the process even easier. Whether you are a beginner or an experienced user, this guide will help you calculate CAGR with ease. So, let’s get started!

How to Calculate CAGR in Excel?

Calculating Compound Annual Growth Rate (CAGR) in Excel is quite easy and straightforward. Just follow these simple steps:

- Open a new Excel spreadsheet and enter the initial value in the first cell.

- Enter the final value in the second cell.

- Calculate the total number of periods by subtracting the initial value’s period from the final value’s period.

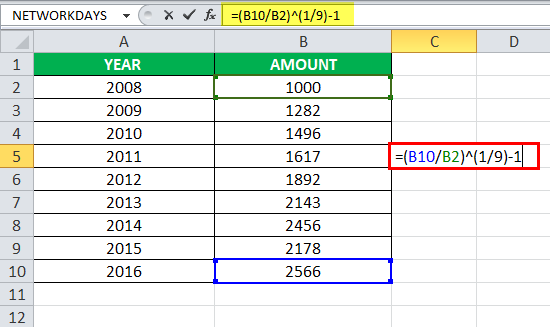

- Calculate the growth rate by using the formula: Growth rate = (Final Value / Initial Value)^(1/Periods) – 1

- Finally, calculate the CAGR by using the formula: CAGR = (Final Value / Initial Value)^(1/Periods) – 1

What is Compound Annual Growth Rate (CAGR)?

Compound Annual Growth Rate (CAGR) is a business and finance measure that shows the rate of return of an investment over a period of time. It is the average growth rate of an investment over a period of time, usually expressed as a percentage. CAGR helps investors to understand the return of an investment over a period of time and compare it to other investments. It is also useful in comparing the growth of a company’s sales over a period of time.

CAGR shows the average rate at which an investment or a company’s revenue grows over a period of time. It is calculated by dividing the value of an investment or the company’s revenue on the last day of the period by the value at the beginning of the period, then taking the nth root of the result, where n is the number of years in the period.

What is the Purpose of Calculating CAGR?

The purpose of calculating CAGR is to provide investors with a better understanding of the returns of an investment over a period of time. CAGR provides a single figure that can be used to compare the growth of different investments and companies over the same period. It is also useful in estimating the future growth of a company or investment.

CAGR is used by investors to determine the performance of their investments over a period of time. It is also used by companies to compare their sales growth to their competitors and to industry averages.

How to Calculate CAGR in Excel?

Calculating CAGR in Excel is a relatively simple process. The first step is to enter the values of the investment or company’s revenue at the beginning of the period and at the end of the period into two separate cells.

Step 1: Enter the Initial and Final Values in Cells

The initial and final values should be entered into two separate cells. For example, if the investment or company’s revenue at the beginning of the period was $100 and the value at the end of the period was $150, these values should be entered into two separate cells.

Step 2: Calculate the Return on Investment

The return on investment (ROI) can be calculated by dividing the final value by the initial value. In the example, the ROI would be calculated by dividing $150 by $100, which gives a result of 1.5.

Step 3: Calculate the Number of Years

The number of years can be calculated by subtracting the start year from the end year. For example, if the period is from 2018 to 2020, the number of years would be 2.

Step 4: Calculate the CAGR

The CAGR can be calculated by using the formula CAGR = (ROI)^(1/n) – 1, where n is the number of years. In the example, the CAGR would be calculated by using the formula CAGR = (1.5)^(1/2) – 1, which gives a result of 14.14%.

Conclusion

Calculating CAGR in Excel is a relatively simple process. It requires entering the initial and final values of the investment or company’s revenue, calculating the return on investment, calculating the number of years and then calculating the CAGR using the formula. CAGR is an important measure of the performance of an investment or a company’s sales over a period of time and is used by investors and companies to compare the growth of different investments and companies.

Top 6 Frequently Asked Questions

What is CAGR?

CAGR stands for Compound Annual Growth Rate and is a measure of growth rate over multiple periods. It is calculated by taking the nth root of the total percentage growth, where n is the number of periods. CAGR is used to measure the rate of return of an investment or business over time. It is often used to measure the performance of an investment or business over a long period of time.

How is CAGR Calculated?

The CAGR can be calculated by taking the nth root of the total percentage growth, where n is the number of periods. For example, if a business had a 10% growth rate over three years, its CAGR would be calculated by taking the cubed root of 1.10 (1.10^1/3 = 1.034). This means the business had a 3.4% CAGR over those three years.

What is the Formula for Calculating CAGR in Excel?

The formula for calculating CAGR in Excel is =((End Value/Start Value)^(1/Periods))-1. For example, if the start value was $100, end value was $150 and the period was 3 years, the formula would be =((150/100)^(1/3))-1. This would give a CAGR of 0.034 or 3.4%.

How to Calculate CAGR Excel?

To calculate CAGR in Excel, first enter the beginning and ending values in two separate cells. Then, enter the number of periods in a third cell. Next, select a fourth cell, enter the formula =((End Value/Start Value)^(1/Periods))-1 and press Enter. This will give the CAGR for the given values.

What are the Advantages of Calculating CAGR in Excel?

The main advantage of calculating CAGR in Excel is that it is quick and easy. Excel is an incredibly powerful tool that can quickly and accurately calculate complex formulas. Additionally, Excel can easily handle multiple sets of data and can quickly calculate CAGR for different scenarios.

What are Some Common Uses for CAGR?

CAGR is commonly used to measure the performance of an investment or business over time. It is also used to compare the rate of return of different investments or businesses. CAGR is also often used to compare the performance of different stocks or mutual funds. Additionally, CAGR can be used to forecast the future performance of an investment or business.

CAGR Function and Formula in Excel | Calculate Compound Annual Growth Rate

Calculating CAGR in Excel requires a few simple steps and can be completed in a matter of minutes. With a few clicks of a button, you can calculate the CAGR of your investments and get a better understanding of the growth of your investments. With the right information and the right calculations, you can make better decisions about your finances and investments. Thanks to Excel, this is now easier than ever.